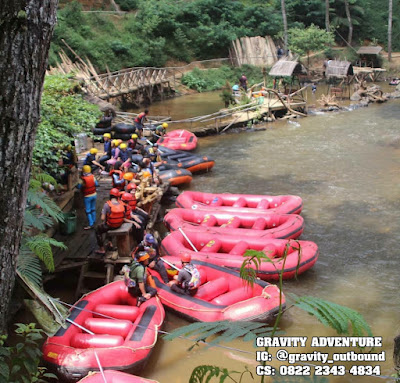

Rafting Bandung Gravity Adventure Pangalengan Bandung West Java merupakan salah satu cara yang bisa Anda lakukan untuk menghabiskan waktu liburan.

Wisata rafting ini merupakan wisata yang berbeda dari lainnya, karena pada wisata ini Anda akan ditantang adrenalinnya dengan menyusuri sungai yang jeram memakai perahu karet.

Rafting sendiri memiliki cukup banyak manfaat, selain sebagai salah satu relaksasi dan menghilangkan stres, rafting juga bisa membentuk otot tubuh. Rafting atau arung jeram dilakukan di sungai-sungai tertentu, jadi tidak semua sungai bisa dipakai untuk rafting.

Salah satu sungai untuk rafting terbaik adalah di sungai Palayangan, Pangalengan, Bandung. Pangalengan ini memiliki banyak sekali tempat wisata, jadi selain rafting Anda juga bisa berkunjung ke tempat wisata lain seperti situ cileunca.

Rafting Bandung Gravity Adventure Pangalengan Bandung West Java

Di kawasan situ cileunca atau dekat sungai Palayangan ada banyak kelompok yang menyediakan jasa rafting di sungai Palayangan.

Jadi Anda tidak perlu khawatir bingung cari jasa rafting di situ, namun sebelum itu sebaiknya cek terlebih dahulu tentang provider jasa yang Anda gunakan di internet. Dan silahkan ketikkn di search “kenapa harus gravity adventure”.

Aliran di sungai Palayangan cukup deras dan memiliki banyak patahan sehingga bisa membuat Anda merasa seperti jatuh ke jurang. Inilah yang membuat rafting menarik, di sini adrenaline Anda akan ditantang.

Namun Anda tidak perlu khawatir karena Anda menggunakan perlengkapan rafting seperti helm, rompi, pelindung, dan lain sebagainya. Selain itu, Anda juga akan dipandu oleh instruktur yang sudah berpengalaman dengan kegiatan rafting.

Jadi ke Pangalengan ini Anda cukup membawa uang saja untuk menikmati wisata ini, tidak perlu membawa perlengkapan rafting dari rumah. Selain itu, Anda juga akan ditawari jasa pemotretan ketika sedang melakukan rafting.

Anda bisa menggunakannya jika memang tertarik dan ingin mengabadikan momen ketika sedang mengarungi sungai Palayangan.

Wisata Lain di Pangalengan

Selain rafting, di tempat ini Anda juga bisa melakukan kegiatan wisata lain yang juga tidak kalah seru.

Contohnya adalah flying fox, jadi di sini Anda akan dibawa untuk melintasi situ cileunca sepanjang 200 meter lewat udara.

Tentunya olahraga ini juga sangat memacu adrenaline Anda, tidak kalah dengan rafting di sungai Palayangan.

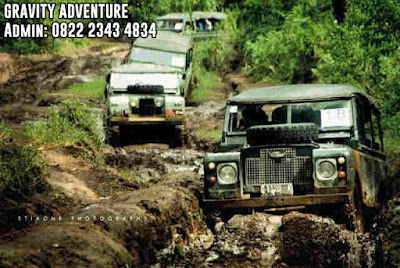

Ada juga bisa offroad, yaitu menaiki mobil besar dan berjalan di atas lumpur dengan trek yang terjal. Selain offroad dan flying fox, Anda juga bisa melakukan perang-perangan dengan musuh yaitu dengan bermain paintball.

Dan yang terakhir, Anda juga bisa berkunjung ke tempat wisata lain yaitu Situ Cileunca. Situ Cileunca merupakan danau buatan yang populer dan menjadi tujuan bagi para wisatawan dalam dan luar kota.

Di danau ini Anda bisa melihat pemandangan yang indah dan menikmati udara yang segar tidak seperti di perkotaan.

Semua wisata ini bisa Anda dapatkan di satu tempat, yaitu Pangalengan kota Bandung, untuk mencapai tempat ini memerlukan waktu sekitar 2 jam dari pusat kota Bandung.

Berminat ya? Silahkan minta pricelistnya dulu saja, karena siapa kapan-kapan berminat.